Video: Mississippi and Louisiana Tops in Car Loan Default

[syndicaster id=’6231641′]

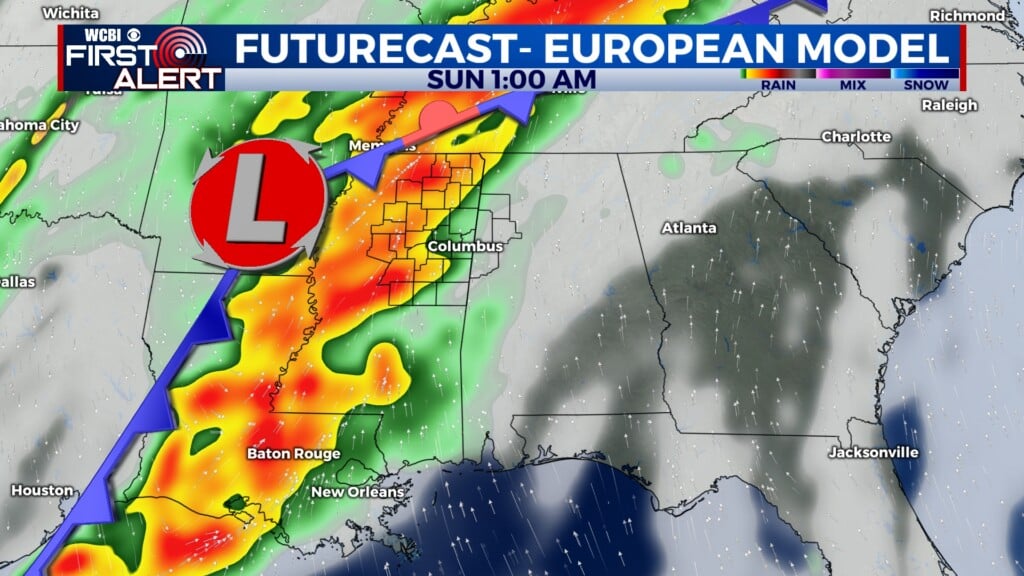

COLUMBUS, Miss. (WCBI) -More drivers are behind on their car payment.

An Experian Automotive study says the highest number of people since 2006 are behind by two months or more.

The top states for defaulting on car loans are Mississippi and Louisiana.

This new car may look like the one for you, or this one, or this one… But before you drive off in one, you should know what you are getting yourself into.

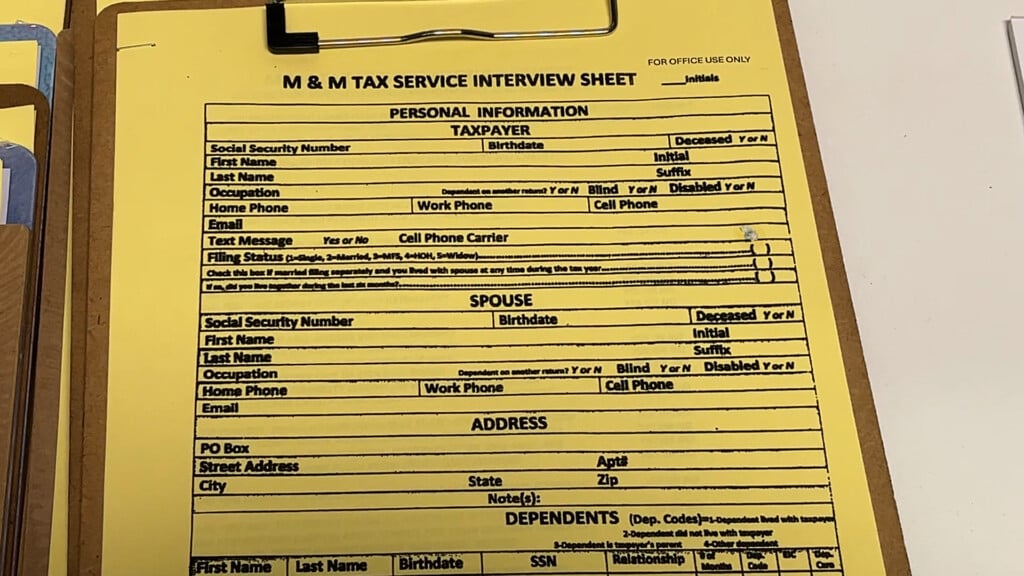

” I think a lot of times people come in and pick a higher priced car than the payment they would qualify for.”

” Mr. Rhea says it’s important to do your homework before you even step into the dealership.”

He has some suggestions to shoot for.

” Your car loan to be somewhere in the neighborhood of 15 percent of your gross monthly income.”

Once you calculate your budget …

” Come in and tell us what would be a comfortable payment for you, or what we could arrive at as a comfortable payment for you, and then we could go out and show you what cars you would qualify for.”

If you take home more than you can handle, don’t be afraid to ask for help.

” Come back to your car dealer and let them know what your situation is. In some cases we can get your loan refinanced for a lower rate, sometimes you can trade into a lesser car loan.”

That way, you can get ahead before you get too behind.

Leave a Reply