Video: New Study: One-Third of Americans Drowning in Debt

[jwplatform 4ksSSG1V]

COLUMBUS, Miss. (WCBI) — If bill collectors are calling you, you’re not alone. A new study shows that one-third of all Americans aren’t paying their bills on time.

“Debt can have a very negative impact on your financial future,” says Financial Planner Scott Ferguson, with Financial Concepts in Columbus.

The Urban Institute has released a study that finds 77 million Americans with poor credit records have been reported to collections agencies. The average debt owed is roughly $5,200. However, when it comes to overall debt levels, much of the debt comes from home mortgages.

“There’s good debt and there’s bad debt. Like a home mortgage, that’s considered good debt. That is you are buying equity into something you own. Bad debt is running up large credit card bills, over due medical bills. All those outstanding things that you really didn’t need to have,” says Ferguson.

Those plastic cards millions swipe every day seem to be at the root of the debt problem.

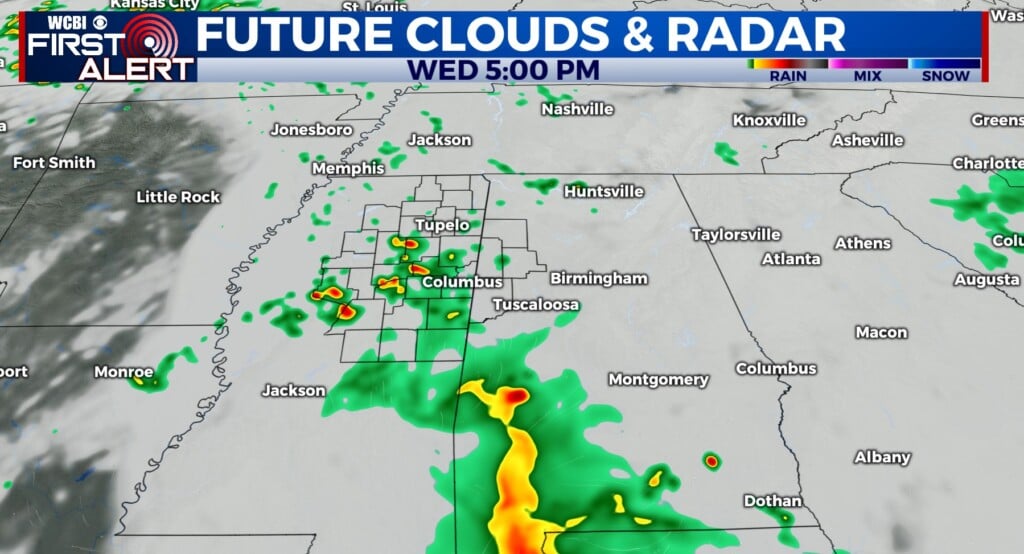

In Mississippi, the average person is about 30,000 dollars in debt. Southern states, including Alabama, Florida, Georgia and Texas have the most people facing debt collectors. Financial experts say there are steps you can take to get out of debt.

“The first thing is if you want to get out of debt, you really need to sit down and analyze your budget. You need to see what you have going in and what you have going out,” says Ferguson.

Nevada ranked the highest with nearly half of Las Vegas residents in debt collections. The report also says that the economic downturn of 2008 played a major role in the rise of unpaid debt.

Leave a Reply